multibook

The Cloud-based Accounting & ERP Service

With the assistance of multibook, you can stay informed in real-time on how well the management of your overseas business unit is performing,

enjoy enhanced internal control, and quickly complete the consolidated financial statement preparation. All of these are possible with only one percent of the cost of using a large-scale ERP system.

A-CAST is an officially authorized distributor of multibook.

Are you troubled by these issues?

- Each of your departments operates with different systems, resulting in troublesome and unorderly coordination

- You have, for so many times, considered introducing the new system to your organization, but those people in charge are against changes in the status quo

- You have been planning to opt out of EXPRESS software and use ERP instead, but things don’t go as smoothly as planned.

Each of your departments operates with different systems, resulting in troublesome and unorderly coordination

Let’s say that your accounting department is using “EXPRESS” software. Meanwhile, the inventory management department opts for “EXCEL,” and “Tiger Software” is the software of choice for the human resource department. If people in charge of each department of your organization use different systems or software, there is a lack of unified ERP.

You have, for so many times, considered introducing the new system to your organization, but those people in charge are against changes in the status quo

You might be aware that diverse practices within each of the company’s departments are issues that shouldn’t be taken lightly, and thus consider introducing a more unified system. However, the introduction of the new system tends to involve cumbersome methods. So far, there are numerous precedents where executives of Thai companies declined the adoption of the new system to avoid hassles.

You have been planning to opt out of EXPRESS software and use ERP instead, but things don’t go as smoothly as planned.

EXPRESS is a software currently used by many Thai enterprises. Decision-makers who are not fond of deviating from the status quo might prefer to customize EXPRESS’s system. In such circumstances, the implementation of the new system can be prolonged, or even be canceled in the worst case.

multibook’s special features

multibook is a cloud-based ERP accounting service with an impressive performance record in the Southeast Asia region including Thailand.

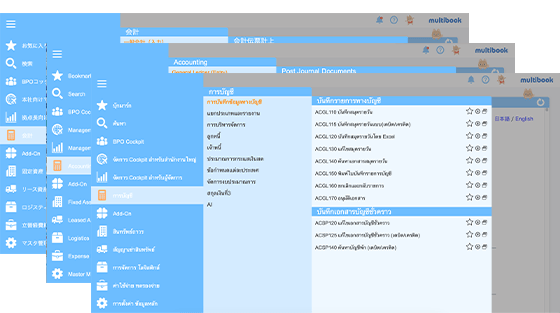

*Image

Assuring full compliance with requirements of tax accounting in Thailand

Accredited by the Thai Revenue Department

multibook was released for sale in Thailand in 2016. Later in March 2020, it was accredited by the Revenue Department of Thailand as the authentic tax accounting software.

This software can comprehensively perform essential tasks including preparing necessary documents such as VAT returns form (PP30), withholding corporate income tax returns form (PND53), and stock card, as well as automatically retrieving the Bank of Thailand reference rate.

Supporting a wide range of languages and currencies, with interoperability across multiple account books

The software’s screen can display in 12 languages including Thai and Japanese, allowing local staff to operate easily.

Since multibook can support a wide range of currencies, it can make and record journal entries

in each particular currency of countries worldwide, as well as performing foreign currency conversion. You will be freed from many of the cumbersome tasks.

Due to its interoperability across multiple account books, multibook can adjust the applicable accounting standard of your current location in conformity with the Japanese one. (The software is also compatible with IFRS)

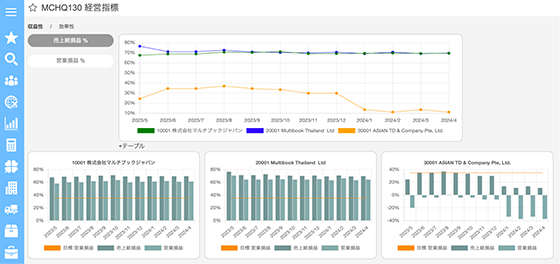

Centralized management of information from multiple locations

All of multibook’s modules can automatically interlink and journal accounting data, ensuring the centralized management of all information from overseas branches of your business group.

Receipts recording data on logistics, fixed assets, leased assets, and expense reimbursements will be automatically journaled into the software’s database. Truly enhanced work efficiency can be achieved since there are no duplicated works of inputting the same data all over again.

Enhanced intra-organization control through the HQ’s viewpoint for a more effective business administration

Achieving a more efficient performance of interlinked account settlement

The scope of the software’s functions can be restricted depending on authorization granted to each specific user. Approving receipts and financial statements can help your organization strengthen internal control. With multibook, it’s possible to attach evidence to individual receipts. Details in the remark column will be auto-translated, ensuring that all details can be viewed and scrutinized.

Full compliance with applicable accounting and taxation requirements of your current location

multibook ensures full compliance with applicable requirements in Thailand. It can assist in preparing necessary documents such as VAT returns form (PP30), withholding corporate income tax returns form (PND53), and stock card, as well as automatically retrieving the Bank of Thailand reference rate.

Contact us here

If you need further information with this product, please contact A-Cast.

The Japanese staff will provide you the clearly information.

Please call : 02-259-5113

(Monday-Friday Daily 8.30 – 17.00 except weekend and public holidays.)